Wings for Autism® event volunteers

Photo Credit – Duncan Moffat

Thank you so much for facilitating the Wings for Autism program which was held in Mobile, AL Saturday. We attended this activity with our daughter who has Down Syndrome. She has never flown. She thrives on rehearsing a situation prior to its occurrence and her participation in this event allowed her to store background knowledge of what to expect when she takes a trip. – Parent from Mobile, AL.

Every April, The Arc joins many other disability rights in the US and around the world in celebrating Autism Acceptance month. It is a time to promote greater understanding of the myriad societal barriers that people on the autism spectrum face on a daily basis and encourage greater inclusion within our communities. For The Arc, April marks one of the busiest and most exciting times for one of its most highly celebrated and recognized national programs: the Wings for Autism®/Wings for All® program.

This year, The Arc of the US worked with local chapters of The Arc, airlines, airports and the Transportation Security Administration (TSA) to bring the Wings for Autism®/Wings for All® program to seven different airports across the country during Autism Acceptance month. Nearly 200 families attended these events, many of whom had no prior air travel experience out of fear that being in an airport or on an aircraft would be too difficult and frightening for their loved one with intellectual and developmental disabilities (I/DD).

WCNC forecaster Larry Sprinkle

Photo Credit – Duncan Moffat

The month began with a festive and historic Wings for Autism® event at Charlotte Douglas International Airport (CLT). The Arc of Mecklenberg County and The Arc of Union/Cabarrus County teamed up with The Arc of the US, Delta Air Lines, TSA an the Doug Flutie Foundation to bring the event to CLT airport for the first time in the program’s history. To honor the occasion, local celebrity and weatherman for WCNC-Charlotte, Larry Sprinkle, was on hand to greet families, take photos and announce the Wings for Autism® flight prior to boarding.

After boarding the plane and visiting the cockpit, participants took their seats for a brief taxi around the runway, which allowed for passengers with disabilities get accustomed to the sensations of a moving plane. As the aircraft came back to the gate, all those on the plane and gate area were surprised with a water cannon salute – an honor reserved only for retiring pilots, inaugural flights for new flight routes, and other rare occasions during which two firefighting rigs spray arcs of water over an arriving or departing flight. This came as a surprise to all families on board, event staff and even several of the flight crew who had never witnessed this unique aviation tradition.

I wanted to say thank you again for you and your organization putting on such a fun, non-stressful event today! We all had such a great experience. We learned so much today and how we can make traveling easier. – Parent from Atlanta, GA

A full flight

Photo Credit – John McHugh/Ocaid Photography

We were delighted to take part in South Bend International Airport’s second Wings event. Not only did Wings provide our new officers with valuable experience of working with individuals with intellectual and developmental disabilities, it also allowed them to share in the joy felt by parents and children as they successfully passed through our security checkpoints. – Armand Collins, Transportation Security Manager, TSA.

These events have an incredible impact on people with disabilities and their families, and we often get heartfelt notes after the event. One such note read: “I don’t have the words to adequately express my thanks for this evening’s Wings for Autism event. We have been so worried about how our daughter would deal with the plethora of unknowns associated with air travel and you have now made future air travel a reality for us. Too many times, as a parent of a child with ASD, you feel like doors are closed to your child and/or your family. Well, tonight, you gave her wings!”

Representatives from Delta Air Lines, CLT airport and TSA were also amazed and humbled by their Wings experience. “Being able to host a Wings for Autism Event was a very special moment for the Delta team in Charlotte,” said Jill MacDonald, Delta Air Lines. “As airline employees we take air travel for granted and for our team to be able to open up the possibility of flying for the families of children and young adults with autism, that was extremely gratifying. This was an unforgettable experience and one that we look forward to hosting for many years to come.”

The Arc of Mecklenberg and The Arc of Union/Cabarrus were thrilled and look forward to another Wings event in the future. “Wings for Autism was probably the most meaningful and impactful event I have been part of professionally,” said Nancy Hughes, Executive Director, The Arc of Mecklenberg. “Delta, Charlotte Douglas International Airport, and TSA all went above and beyond to make the event amazing for participating children and families. The consensus feedback from families indicated that it was life-changing, because it opened the door to travel that many thought was closed.”

Looking for a Wings event in your city? Keep an eye on our event listing!

Originated by the Charles River Center, a local chapter of The Arc in Massachusetts, and the Massachusetts Port Authority, Wings for Autism® was created to alleviate some of the stress that families who have a child with autism experience when traveling by air. The program also provides TSA agents, airline and airport staff with a unique perspective on the challenges that individuals with autism spectrum disorders and other disabilities face in air travel and much-needed training on how to better meet the needs of individuals with disabilities and their families.

During the past six months, most of my professional life has been consumed by the fight to save Medicaid. Today I was honored to speak as a sibling and professional at a Capitol Hill event celebrating the 52nd anniversary of Medicaid and Medicare, to highlight why we must continue our fight to SAVE MEDICAID.

During the past six months, most of my professional life has been consumed by the fight to save Medicaid. Today I was honored to speak as a sibling and professional at a Capitol Hill event celebrating the 52nd anniversary of Medicaid and Medicare, to highlight why we must continue our fight to SAVE MEDICAID. We know the numbers – between 22-32 million will lose coverage, millions will lose Medicaid and anywhere from $202 billion (in the “skinny repeal”) to $836 billion (in the House bill) in cuts to federal Medicaid spending. But those numbers represent people, they represent Chris, they represent the 43 heroes from National ADAPT that were arrested last month after staging a die in at Senator McConnell’s office.

We know the numbers – between 22-32 million will lose coverage, millions will lose Medicaid and anywhere from $202 billion (in the “skinny repeal”) to $836 billion (in the House bill) in cuts to federal Medicaid spending. But those numbers represent people, they represent Chris, they represent the 43 heroes from National ADAPT that were arrested last month after staging a die in at Senator McConnell’s office. Families like mine started The Arc over 65 years ago to get people OUT of Institutions and included in their communities, and now those antiquated and segregating services may be the only thing left. This is because institutions and nursing homes remain mandatory services, while home and community based services are optional, and will therefore be the first cut when the devastating federal cuts to Medicaid come to the states. We cannot let that happen, we must SAVE MEDICAID. People’s lives literally depend on it. Chris’ does.

Families like mine started The Arc over 65 years ago to get people OUT of Institutions and included in their communities, and now those antiquated and segregating services may be the only thing left. This is because institutions and nursing homes remain mandatory services, while home and community based services are optional, and will therefore be the first cut when the devastating federal cuts to Medicaid come to the states. We cannot let that happen, we must SAVE MEDICAID. People’s lives literally depend on it. Chris’ does.

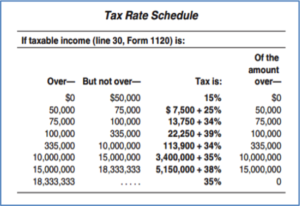

One of the reasons for this drop is changes in how corporations are operating and being taxed. An increasing number of corporations’ profits are subject to no taxation (foreign profits that stay abroad) or different taxes (income tax in the case of

One of the reasons for this drop is changes in how corporations are operating and being taxed. An increasing number of corporations’ profits are subject to no taxation (foreign profits that stay abroad) or different taxes (income tax in the case of